-

Par pgrenaud le 2 Décembre 2013 à 22:18

Good evening Ladies and gentlemen,

This is a good new to the "applemaniac !

"

Retailers pushing their sales for Cyber Monday and the rest of the holiday season can take note of the pattern from Black Friday. Brand-name electronics, led by Apple Inc.’s AAPL +0.01% iPad — which graced the front page of several retailers’ Black Friday print circulars — were the hottest sellers.

At Wal-Mart Stores Inc. WMT -0.10% and Target Corp. TGT -0.40% , the iPad Mini 16GB and iPad Air 16GB were the top sellers, respectively, according to market research firm InfoScout, which tracked the spending of 50,000 in-store shoppers, mostly ages 21 through 55, on Thursday and Friday.

The various iPad products represented 18% of Target’s sales, said InfoScout CEO Jared Schrieber. The iPad Mini alone accounted for 6.5% of Wal-Mart’s sales on Black Friday.

At Best Buy Co., Inc. BBY -0.02% , Microsoft Corporation’s MSFT -0.03% Surface 32GB tablet was the top seller, followed by Apple’s iPad 2, echoing observations from a MarketWatch store visit on Thursday night. (Watch my interview with a Best Buy shopper).

Online, price-comparison site PriceGrabber.com said its research also showed iPad Air and iPad Mini were the top searched items of the weekend since Thanksgiving.

On the game console front, while some data suggested Sony Corp.’s SNE +1.61% PlayStation 4 was mentioned more on social media Friday than Microsoft’s Xbox One, the InfoScout data showed the Xbox One garnering 31% of the gaming market Friday, twice that of the PlayStation 4, which logged 15%.

“PlayStation 4 was a hit with consumers,” Schrieber said. “But it was out of stock. [It] missed out on an enormous sales opportunity.”

On Monday morning, both consoles were listed as out of stock or unavailable on major retailers’ websites, including specialty retailer GameStop Corp. GME +0.04% (Although GameStop has an Xbox One bundle listed as available for sale.)

Echoing other data that showed the earlier store openings and deal pushes on Thanksgiving did steal some of Black Friday’s traffic, InfoScout data also showed that traffic spiked around 8 p.m. Thursday evening before dying down, then picking up again around 11 a.m. on Friday. Mall-traffic tracker ShopperTrak said on Saturday that total Thanksgiving and Black Friday traffic rose 2.8% to 1.07 billion store visits since last year, while sales increased by 2.3% to $12.3 billion. However, excluding the impact of Thursday, Black Friday traffic and sales dropped 11.4% and 13.2% respectively.

A survey from the National Retail Federation on Sunday pointed to a spending decline this past weekend. It said consumers remain cautious about their spending this holiday. An InfoScout study showed that on Black Friday, 85% of shoppers said they were doing shopping for themselves, suggesting a similar trend that is a cause for retailers to worry.

“It’s an indicator that people aren’t spending as much this holiday season on gift items,” Schrieber said."

http://blogs.marketwatch.com/behindthestorefront/2013/12/02/apples-ipad-is-the-black-friday-winner/

Bonne nuit.

See you

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 23 Novembre 2013 à 17:27

Bonsoir à tous,

Voici une information bien triste dans le "landerneau" de l'économie.

Deux concurrents s'acharnent à détruire l'autre, alors que l'un est le fournisseur de l'autre.

L'innovation ne doit pas passer par la destruction non créatrice.

Voici un article révélateur de la dérive de notre économie sans encadrement.

"La justice réduit l'amende que Samsung doit verser à Apple

Un jury américain a condamné le groupe d'électronique sud-coréen à verser 290 millions de dollars à son concurrent pour des violations de brevets.

Samsung a finalement obtenu une petite réduction de l'amende géante d'un milliard de dollars qu'il avait été condamné à verser à son rival américain Apple pour des violations de brevets, mais la facture reste salée. Un jury de San José en Californie, qui rejugeait une partie de l'amende, a estimé jeudi que Samsung devait payer environ 290 millions de dollars à Apple pour des dommages causés par plusieurs de ses produits ayant violé des brevets de l'iPhone.

Le montant auquel sont arrivés les 8 femmes et 2 hommes du jury après une semaine de procès et trois jours de délibération est un peu inférieur aux 380 millions réclamés par Apple, mais nettement au-dessus des 53 millions évoqués par Samsung.

Apple «reconnaissant», Samsung «déçu»

Avec d'autres dommages validés auparavant par une juge, et sous réserve de son feu vert au verdict de jeudi, Apple estime que Samsung lui doit désormais près de 930 millions de dollars. «Pour Apple, cela a toujours été davantage une affaire de brevets que d'argent», a toutefois assuré une porte-parole jeudi. «Il s'agit de l'innovation et du dur travail permettant d'inventer des produits que les gens aiment. Il est impossible de mettre un prix sur ces valeurs, mais nous sommes reconnaissants envers le jury d'avoir montré à Samsung que la copie avait un coût.»

Le groupe sud-coréen s'est pour sa part dit «déçu d'une décision basée en grande partie sur un brevet que l'office américain des brevets a récemment jugé invalide», selon une porte-parole. Samsung avait demandé à la juge de geler la procédure en attendant une décision de cet office sur un brevet déposé par Apple sur le fait de pincer avec deux doigts sur l'écran pour zoomer. Il compte poursuivre ses procédures d'appel «tout en continuant d'innover avec des technologies révolutionnaires et des produits aimés par nos clients tout autour du monde», a ajouté sa porte-parole.

Samsung avait initialement été jugé coupable de violations d'une série de brevets d'Apple le 24 août 2012 par un autre jury de San José, qui avait estimé les dommages à 1,05 milliard de dollars. Début mars, la juge Lucy Koh avait toutefois invalidé une partie de cette amende dont elle contestait le mode de calcul, et ordonné un nouveau procès pour refaire les comptes.

«Plutôt lucratif»

«Samsung aurait dû apporter un peu plus de preuves pour soutenir son cas», a expliqué jeudi une jurée, Colleen Allen, une infirmière de 36 ans. Un avis partagé par la plus jeune membre du jury, Justine Aguilar-Blake, qui fête ses 27 ans vendredi. Elle a toutefois également relevé que «quelques-uns des autres jurés ne savaient même pas comment tenir un smartphone».

Apple et Samsung s'affrontent devant les tribunaux sur plusieurs continents. Les démêlés judiciaires des deux groupes en Californie ont particulièrement retenu l'attention en raison de l'ampleur des violations considérées (lors du premier procès l'an dernier, les jurés avaient dû examiner 700 plaintes au total) et du niveau particulièrement élevé des pénalités financières.

Mais Apple a aussi gagné récemment devant une autre instance américaine, la commission du commerce international, l'interdiction de certains appareils anciens de Samsung. Il a aussi obtenu qu'une interdiction similaire, frappant certains de ses iPad et iPhone, soit annulée par l'administration Obama, qui a en revanche rejeté la même demande faite par le rival sud-coréen."

(Source Le Figaro et l'AFP)

http://www.lefigaro.fr/secteur/high-tech/2013/11/22/01007-20131122ARTFIG00435-la-justice-reduit-l-amende-que-samsung-doit-verser-a-apple.php

A vos réflexions.

Bien à vous.

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 14 Octobre 2013 à 23:12

Bonsoir à tous,

Des prédicteurs en tout genre ont estimé que la valeur de la compagnie californienne d'informatique (APPLE) ne valait pas grand choses.

Pas grand chose ?

Selon Interbrand, ce serait la première valeur.

(http://www.interbrand.com/fr/best-global-brands/2013/Best-Global-Brands-2013.aspx)

Selon Bloomberg, ce serait la première valeur boursière avec une capitalisation de plus de 450 Mdk de $ !

Je rappelle que la deuxième (EXXON est à moins de 380 Mdk $ !!!) et je ne parle pas des autres...

Mais non, AAPL n'est pas une grande société cotée au NASDAQ !

Finalement, il vaut mieux écouter ces analystes financiers en tout genre, et il y en a ! Qui veulent des marges à 30, 40 voire 50% par an, comme si l'argent pouvait pleuvoir de leurs vareuses trouées.

En d'autre terme, l'économie fait l'objet d'une analyse de la part d'analyste qui ne font qu'analyser leurs "point of view".

Faites vous votre opinion et comme nous le faisait rappeler le co-fondateur d'APPLE (Steve Jobs) "Thinks different !"

Bien à vous.

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 3 Juillet 2013 à 17:44

Hello Ladies and gentlemen ,

This is the iCnomy news today.

See you soon.

PGR

1 commentaire

1 commentaire

-

Par pgrenaud le 17 Mai 2013 à 15:21

Hello Ladies and gentlemen,

Read this new :

NEW YORK (TheStreet) -- Apple (AAPL_) iPads may be commonplace in homes and offices, but the popular tablet is now a key weapon in the U.S. Air Force's battle for efficiency

. The lightweight Apple tablet has opened the door to more than $50 million in cost savings over the next 10 years, according to the military.

. The lightweight Apple tablet has opened the door to more than $50 million in cost savings over the next 10 years, according to the military.Last year the Air Force's Air Mobility Command (AMC) awarded a $9.36 million contract for up to 18,000 iPads as part of an ambitious project to replace flight manuals with state-of-the-art tablets. Contractor Executive Technology

clinched the deal to deploy the so-called Electronic Flight Bags (EFBs).

clinched the deal to deploy the so-called Electronic Flight Bags (EFBs).AMC, which provides Air Force cargo, passenger transport, refueling and aeromedical evacuation services, aims to boost efficiency and save millions of dollars through the tablets. For a typical aircrew, this means doing away with dozens of manuals containing literally tens of thousands of pages of information.

"We're saving about 90 pounds of paper per aircraft and limiting the need for each crew member to carry a 30 to 40 pound paper pile [of flight manuals]," said Major Brian Moritz, EFB program manager, in a phone interview. "It adds up to quite a lot of weight in paper."

The weight savings vary by aircraft across AMC's vast airfleet, from as much as 250 pounds in a four-person C-17, up to 490 pounds in a hulking C-5 with its 10 crewmembers.

This journalist saw one of these iPads in action during his recent embed with the U.S. Air Force. In addition to easing the physical burden on aircrew, who no longer need to haul heavy flight manuals, the Department of Defense

is also making big financial savings.

is also making big financial savings."By removing all that paper, AMC will capture about $750,000 in fuel savings [annually] just based off the decreased weight," said Moritz.

Removing the need to print and distribute thousands of flight manuals, however, equates to an even greater cost saving. "It comes out to just over $5 million a year," noted Moritz. "With fuel savings, it comes out to $5.7 million annually in pure cost. When you look at $5.7 million a year, over 10 years, that's well over $50 million."

Some 16,000 of the third-generation iPads are now being used by AMC aircrew, with the contract's remaining 2,000 iPads deployed across other Air Force units. The device's 9.7-inch display, its user interface, and the ability to access information rapidly were all key selling points, according to Moritz."

If you would like to follow this information, this is the link :

See you

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 15 Mai 2013 à 17:13

Hello everybody,

"Apple (AAPL) is in the Danger Zone. Too many investors see AAPL through the rear view mirror and assume that its sky-high profits and return on invested capital (ROIC) are sustainable. As detailed in my Jan 25th CNBC interview, Apple is not cheap and investors should not underestimate the impact of losing Steve Jobs. (Note that I am doing another CNBC interview at 10:35am ET today.)

Without another ground-breaking innovation like the iPhone, Apple is destined to be just another consumer electronics company. And the stock is very expensive relative to other technology and consumer electronics stocks.

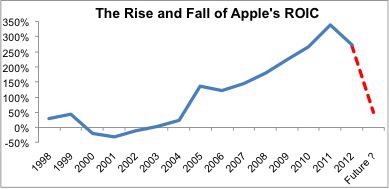

Almost a year ago, I wrote a bullish article on Apple, arguing that its sky-high ROIC made it a great value for investors even at such a high price. Since then, the company's ROIC fell from 340% to 271%. Add the lack of innovation and issues with new products, and I see the recent drop in ROIC as a new trend. Without significant product differentiation, Apple cannot maintain the ultra high profit margins and ROICs.

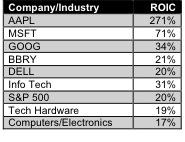

Comparing Apple's ROIC to its competitors and industry averages provides fair benchmarks for what might be a more reasonable future level of ROIC for AAPL.

Figure 1 compares Apple's ROIC to competitors Microsoft (MSFT), Google (GOOG), Blackberry (BBRY) and Dell (DELL) as well as the market-weighted average ROICs of different industry segments. This figure shows just how far Apple's ROIC could fall if it returns to more normal levels, which I think is inevitable after the departure of Steve Jobs. The problem is that AAPL is priced to maintain a sky-high ROIC of 124%.

Figure 1: Apple Versus its Competitors

Sources: New Constructs, LLC and company filings

No Longer a "Value" Stock

People think AAPL is a value stock, but that's only the case if one assumes its current ROIC is sustainable. AAPL's current valuation of ~$443.86/share implies a long-term ROIC of 124%. I think that level of profitability is still too high to maintain.

If we assume Apple can maintain an ROIC close to Microsoft's, around 75%, then the stock is only worth ~$295. If Google's 34% ROIC is the benchmark, the stock is worth only ~$191. If we assume Apple can maintain a long-term ROIC of 20%, which is still high in the consumer electronics sector, the stock is worth ~$162.

The "value" in Apple is an illusion. Astute investors need to look at Apple through the lens of what is a reasonable ROIC in the future.

The Law of Competition Reverts ROICs To The Mean

Super high ROICs are a blessing and a curse. On the one hand, a 340% ROIC is an unprecedented achievement for a company Apple's size. On the other hand, it invites lots of competition from businesses seeking to get in on those high margins.

For years, Apple's superior products could demand premium pricing. Today, other phone and tablet makers are quickly narrowing the gap between their products and Apple's. The differences between an iPhone and a Samsung Galaxy or a Motorola Droid are no longer enough to justify a major difference in price.

The loss of Steve Jobs hits Apple extremely hard when it comes to innovation and product quality. His energy, creativity, and attention to detail played a critical role in enabling Apple to stay ahead of the pack for as long as it did. Without him, Apple has not come up with any significant new innovations and appears to be falling a bit behind the competition. The Apple Maps fiasco last year revealed how much the company missed his attention to detail.

Taking the competition to court does not stop them. It only slows them down - at best. Apple's $1 billion verdict in its patent infringement lawsuit against Samsung last year was encouraging, but that amount was reduced 50% on appeal. Patent suits are very expensive (time and money) and difficult to prosecute. As hard as it tries, Apple will not be able to sue its competitors out of business. Google, Samsung, Blackberry, Microsoft and many other firms will continue to put out phones, computers, and tablets that will be increasingly competitive with or better than Apple products. Apple needs another ground-breaking new product to maintain margins and profit growth.

Do not get me wrong. Apple is still a great company and an American icon that gave us amazing new devices. My point is that a great company does not make a great stock. And AAPL is not a good stock.

Figure 2: ROIC Has Peaked

Sources: New Constructs, LLC and company filings

Beware of Groupthink

Normally I end these articles by warning investors to avoid the ETFs and mutual funds that allocate significantly to the stock in the Danger Zone. With AAPL, there are too many funds to include in this report.

An astounding 664 of the 7,000 ETFs and mutual funds I cover allocate at least 5% of their value to AAPL. Mutual fund managers have caught a serious case of groupthink when it comes to AAPL. No fund manager or ETF provider wants to have to explain to investors why they did not own AAPL if the stock takes off again. So, they keep the allocation rather than do more independent research.

Mutual fund managers and ETF providers are too often focused on performing in line with their peers. That strategy helps protect them from losing market share. In the event of a market downturn or a big drop in a widely-held stock, they are protected from losing assets as long as all or a majority of other funds underperform along with them. The goal is to avoid being singled out and risk losing more assets than peers.

Disclosure: Sam McBride contributed to this article. David Trainer owns MSFT. David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme."

votre commentaire

votre commentaire

-

Par pgrenaud le 24 Avril 2013 à 15:16

Hello,

These opinion is fun !!!

"The long awaited, much hyped Apple earnings report came out last night and offered a little something for everyone, particularly investors who've been arguing that the company has much bigger problems than a slumping stock price.

The Good

Apple (AAPL) reported earnings of $10.09 per share on revenues of $43.6 billion.Wall Street analysts had been looking for $10.07 on $42.3 billion in revenues.It was a slight beat of estimates that had fallen nearly 14% in the last month.

The Bad

* For the current fiscal period Apple lowered its revenue forecast to between $33.5 and $35.5 billion, well below the Street's estimate of $38.2b. In the same quarter in 2012, Apple booked $35b in sales and earned $9.32 per share.

* Gross margins also missed expectations at 37.5%, compared to expectations of 38.5%. In the same quarter last year, Apple's gross margin was 47.4%. The company says it expects margins in the current quarter to be between 36 and 37% compared to 43% in the quarter ending June 29 of 2012.

* Splitting the middle on revenue and gross margin guidance, Apple would gross profit of $12.6 billion vs. $15 billion last year. Unless the company finds a score of ways to cut expenses -- and they don't seem to have any plans to do so -- net income would come in somewhere near $7.5b or a drop of 15 - 16%, year over year.Assuming the number of share outstanding remains constant (a generous assumption), Apple would earn in the vicinity of $8 per share in the current quarter, compared to $9.30 last year.

The average analyst estimate for this quarter is $9.08.Expect that number to fall in earnest -- if not this morning, very soon.Apple is now running well below results that would get the company anywhere near the average estimate of $43.66.

* The company has spent $2.1b on R&D over the last 6 months, putting it on pace to spend around $4.2B for the year.To be generous, we'll say Apple's expected R&D expenditures are about 2.5% of revenues.To compare, the percentage of revenues used for R&D at Microsoft (MSFT), and Samsung are about 11% and 6% respectively.

Despite the questions raised by this underinvestment in new products, Apple stubbornly refuses to discuss timing on new product roll-outs. "Our teams are hard at work on some amazing new hardware and services we can't wait introduce this fall and throughout 2014," CEO Tim Cook said vaguely on last night's conference call.

Pressed further, Cook said "I don't want to be more specific, but I'm just saying we've got some really great stuff coming in the fall and all across 2014."

Apple had dropped 5% by the end of the call, taking back all of its after hours gains. Careful listeners could actually hear analysts dropping estimates.

The Buyback

Apple also announced that it would be expanding its share buyback program from $10 billion to $60 billion and jacked its dividend by 15% to $3.05 a share.The company said it would be borrowing money to pay for the increased outlays.In doing so, it will be able to avoid paying a repatriation tax on the $102B of its $144B cash hoard being held overseas.Since Apple has the same debt rating as the U.S., borrowing money here is a smart play. On the other hand, using that cash for a buyback and token bump to the dividend yield is asinine.

Apple's existing buyback program was launched October 1st of last year. Since then, the company has spent $1.95B buying shares at an average cost of $478.The stock has fallen more than 40% since the buyback went live and shares purchased have lost 15% of their value."

(Source : http://finance.yahoo.com/blogs/breakout/apple-good-bad-rotten-115009507.html?vp=1)

See you and sell (or buy) AAPL share ?

PGR

In late February, Hedge Fund manager David Einhorn made the case that conventional buybacks and dividends are an inefficient use of shareholder money. Einhorn didn’t just complain, he created an alternative he dubbed iPrefs and presented the idea in a rather compelling power point slideshow.

Cook dismissed Einhorn’s proposal as a “silly sideshow” then failed to even slightly deviate from the ancient and demonstrably futile Dividend/ Buyback combination so long favored by companies running low on ideas and creativity.

Regardless of what Apple’s stock does in the near term, yesterday’s performance left little doubt that Cook is not only a pale imitation of Steve Jobs but a low-rent version of John Sculley.

Apple is now just a depressing reminder that the circle of life applies to all living things, even Apple.

votre commentaire

votre commentaire

-

Par pgrenaud le 9 Février 2013 à 09:56

Morning,

Apple (AAPL) shares may be on a downward spiral these days, but the company's money-making iPhone is in high demand.

It's a paradox !

The smartphone gained 2% market share in the U.S. between October 2012 to December 2012, according to recent to comScore data. During those three months Apple held 36% of the market, making it the #1 smartphone maker in the U.S.

Apple sold a record 47.8 million iPhones in its last fiscal quarter,compared to 37 million in the year-ago quarter. But those figures missed Wall Street's expectations and the stock fell on the news. Apple shares are down nearly 15% year-to-date.

According to comScore, 126 million people in the U.S. owned a smartphone during that three month period, up 5% from September. Samsung controlled 21% of the smartphone market versus 9.1% for HTC and 10.2% for Motorola.

Finally, Apple may be leading its rivals in the U.S. but the company lags in other major global markets.

Thinks different !

Best regards

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 28 Janvier 2013 à 11:44

Bonjour à tous,

Pour les addicts de la pomme...

Bien à vous.

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 25 Janvier 2013 à 10:26

Bonjour à tous,

Les résultats d'Apple.inc sont décevants :

- 137,5 milliards de dollars de free cash flow,

- Chiffre d’affaires de 54,5 milliards de dollars en 2012, contre 46,3 milliards en 2011,

- 47,8 millions d’iPhone,

- 22,9 millions d’iPad en trois mois,

- Le bénéfice est quasiment stable à 13,1 milliards de dollars,

- La marge brute du groupe a chuté de 6 points pour revenir de 44,7% à 38,6%.

Ppour compléter vos analyses financières, vous pouvez consulter ces quelques articles:

Bref, nous sommes face à des résultats financiers que nombre d'entreprises dans le monde lui envient, mais voilà, c'est APPLE et APPLE doit être magique alors lorsque la magie tend à diminuer, les investisseurs font les difficiles.

Je pourrais fais la même remarque pour son grand rival MICROSOFT.

Par conséquent, la valeur boursière a chuté de 10% en une séance pour donner un signal à la firme de Cupertino pour faire rêver les investisseurs à nouveau. Mais les consommateurs rêvent eux, depuis longtemps...

Nous vivons donc dans une société où l'on est capable de sanctionner les meilleurs.

Puisse que ces mêmes censeurs évaluer avec la même rigueur et autorité d'autres institutions mais il est vrai qu'elles ne font plus rêver depuis longtemps.

Bien à vous.

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 11 Janvier 2013 à 19:06

Welcome dear friend ,

Today, we remark that Apple decrease 'level of love' to the young people !

Help Steve !

"Apple is losing popularity amongst American teenagers, claims youth-targeted marketing agency the Buzz Marketing Group. "Teens are telling us Apple is done," BMG's Tina Wells remarks to Forbes. "Apple has done a great job of embracing Gen X and older [Millennials], but I don’t think they are connecting with Millennial kids. [They’re] all about Surface tablets/laptops and Galaxy."

votre commentaire

votre commentaire

-

Par pgrenaud le 8 Janvier 2013 à 16:21

Bonjour à vous,

Une compagnie informatique a présenté à la fin de l'année 2012, un nouveau produit servant à nous rendre toujours plus addict à la numérisation des données.

D'ordinaire, ce genre de création de "hardware" et de "software" est davantage l'apanage des hommes qui considèrent que l'informatique est une pratique digitale et donc masculine.

Ce précieux et délicat objet vient d'être offert à une amie qui est assez rêtive sur les questions informatiques.

Comment considérer des touches électro-magnétiques et un écran LCD pour faire pâmer d'amour une femme ?

Les formes et le contenu sont généralement prévus pour la gente masculine.

Seulement voilà !

Lorsque l'on voit l'objet :

A partir de là, comment voulez-vous que les femmes ne soient pas séduites par un objet qui devient un accessoire et pourquoi pas un plumeau pour leur remise en beauté de leur agenda, leur RDV, leurs différentes notes et humeurs, leurs photos et finalement leurs intimités ?

Je m'avance peut-être un peu, mais lorsque je vois son cousin l'iPad et ses suivants, je me dis que les concepteurs de la marque à la Pomme n'ont pas complètement éludé cet aspect des choses.

N'hésitez pas à le caresser et le faire vibrer de vos émotions dans vote Premium Reseller Apple ou AppleStore le plus proche.

Bien à vous.

PGR

votre commentaire

votre commentaire

-

Par pgrenaud le 21 Décembre 2012 à 18:02

Cher (e) ami (e) bonsoir,

Je vous informe que le téléscope Hubble vient de nous faire découvrir une nouvelle planète dans notre galaxie !

Voyez plutôt :

C'est impressionant non ?

Nous venons de recevoir d'autres clichés :

Impressionnant !

Un cliché plus précis nous montre des contours surprenants !

Les experts de la NASA et les astronomes nous assurent qu'ils cherchent par tout les moyens de connaître et pouvoir mettre un nom à cette nouvelle planète. Pour notre part, nous aimerions bien l'appeler Steve, mais on ne sait pas trop.

D'autres experts (climatologues et géophysiciens) nous informent qu'ils voient, eux-aussi, d'étranges phénomènes ; je vous les propose à votre sagacité :

Une nouvelle configuration de la Terre !

Un nouveau type de Cyclone tropical !

Tout le monde voit la pomme partout...

Dans n'importe quoi...

et même (car il ne faut pas perdre le rythme) :

Bon ! Restons un peu sérieux et ne prenez pas toute information pour argent comptant !

Restez vous même !

PGR

votre commentaire

votre commentaire Suivre le flux RSS des articles de cette rubrique

Suivre le flux RSS des articles de cette rubrique Suivre le flux RSS des commentaires de cette rubrique

Suivre le flux RSS des commentaires de cette rubrique

Le Blog de l'écriture en mouvement - The blog of writing in motion - El blog de la escritura en movimiento